Citibank has announced significant changes to the rewards programs attached to the Signature and Prestige cards. These changes introduce a new points earning structure, with earn rates varying by merchant categories. At the same time, adjustments to transfer rates to other loyalty programs are being made, and not in a good way.The Citibank website has been updated advising that the changes are due to take effect from June 13, 2017.

The cards affected by the change include are the Signature and Prestige cards. There are two different reward options on these cards. You can earn wither Citi Reward Points or Qanta Points. There are slightly different changes being made depending on the cards points earning style.

In general, the changes affect the base earn rate on the card, which will fall. However, Ciitibank will be offering additional points on certain categories of merchants. As a result, depending on where you use the card, you could be better off, or worse off.. It is something you will need to take a look at based on your own situation.

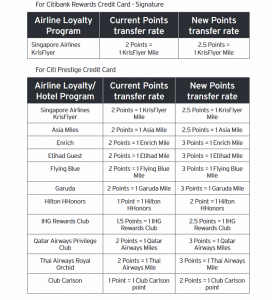

As if that wasn’t enough, Citibank are also changing the transfer rates to a range of airline and hotel partners. There are some significant devaluations in this area, especially to some of the hotel programs.

Why the Changes?

These changes are being made as a result of regulatory changes in the credit card market. The main changes that affect rewards cards are coming into effect on July 1, 2017. These changes limit the amount of fees ypur bank issuer will earn when you use the card, hence the overall reduced rate.

Other banks have been making changes to their own card portfolios as a result of these changes. For example, ANZ recently made changes to its set of rewards cards, including withdrawing American Express cards from its range.

Citibank Prestige

Citi Rewards

If you collect Citi Reward Points, the following changes are being made

- The current earn rate of 2 Points for Domestic Spend will be replaced with a tiered earn rate based on spend categories; and

- Points earn on International Spend will decrease from 5 Points per $1 spent to 3 Points per $1

Qantas Points

If you are collection Qantas Points, the following changes are being made

- The current earn rate of 1 Point for Domestic Spend will be replaced with a tiered earn rate based on spend categories; and

- Points earn on International Spend will increase from 1 Point per $1 spent to 1.5 Points per $1

| Citibank Signature | ||

|---|---|---|

| Earnings Style | ||

| Earn Category | Citi Rewards | Qantas Points |

| Selected purchases made and booked directly from a range of major restaurants and restaurant chains, major hotel chains and flights directly booked with major airlines | 3 Points per dollar. | 1.5 Qantas Points per dollar |

| Selected purchases made at major petrol outlets, major supermarkets and major national retailers | 2 Points per dollar | 1 Qantas Point per dollar |

| Spend everywhere else on Eligible Transactions | 1 Point per dollar | 0.5 Qantas Points per dollar |

| ,International Transactions | 3 Points per Dollar | 1.5 Points pe dollar |

Citibank Signature

Citi Rewards

If you collect Citi Reward Points, the following changes are being made

- The earn rate of 1.5 Points for the first $20,000 spent on Domestic Spend each Statement Period will be replaced with a tiered earn rate based on spend categories; and

- Points earn on International Spend will increase from 1.5 Points per $1 spent to 2 Points per $1 spent

Qantas Points

If you are collection Qantas Points, the following changes are being made

- Earn rate for Domestic Spend of 1 Point for the first $3,000 spent each Statement Period and 0.5 Points for spend from $3,001 to $10,000 each Statement Period will be replaced with a tiered earn rate based on spend categories with a new maximum Domestic Spend of $20,000 spend per Statement Period in the 0.5 points spend category, with two other categories not subject to a maximum spend limitation per Statement Period.

| Citibank Signature | ||

|---|---|---|

| Earnings Style | ||

| Earn Category | Citi Rewards | Qantas Points |

| Selected purchases made and booked directly from a range of major restaurants and restaurant chains, major hotel chains and flights directly booked with major airlines | 2 Points per dollar | 1 Qantas Point per dollar |

| Selected purchases made at major petrol outlets, major supermarkets and major national retailers | 1.5 Points per dollar | 0.75 Qantas Points per dollar |

| Spend everywhere else on Eligible Transactions | 1 Point per dollar | 0.5 Qantas Points per dollar |

| ,International Transactions | 2 Points per dollar | . |

Higher Earning Categories

As can be seen above, Citibank is introducing an expanded tiered earing style. Under this system, additional points are available when spending at certain categories of merchants. The first thing to be aware of is that the exact category a merchant belongs to is chosen by the merchant and card scheme. Unfortunaly, it is difficult to know exactly how a merchant has categorised themselves.

Citibank also call out that spend needs to be directly with the merchant to be eligible:

Please note purchases not ordered or booked directly from the restaurant hotel or airline (e.g. through a delivery company, travel agent, or aggregation site) are not included in the higher earn rate.

Government Spend

Citibank are expanding the definition of excluded government spend. Any spend in these categories will not earn any points at all. From June 17, 2017, the following spend will no longer earn points

Government related transactions include transactions with government or semi-government entities, or relating to services provided by or in connection with government (for example but not limited to or transactions made at Australia Post, payments to the Australian Taxation Office, council rates, motor registries, tolls, parking stations and meters, fares on public transport, fines and court related costs

Transfer Rates

On the other side of the equation, are changes in using your points. In particular, Citibank are changing transfer rates to a number of partners. The following shows the extent of these changes

Citibank have also flagged that the number of points required for gift vouchers and the like will also be changing. The changes are not quatified anywhere though. As a result, it is a bit of a wait and see game.

The updated Terms and Conditions that detail the changes can be found here.

Summary

Taken together, the changes in earn and burn are quite significant. How they affect any individual cardholder will vary depending on their card use. You will need to look into your own individual situation to determin whether the changes are overall positive or negative.